🏠 10 Real Estate Misunderstandings That Still Trip People Up

- Alexandra Starrett

- Jul 9, 2025

- 3 min read

Real estate is full of half-truths and outdated advice. Whether you're buying your first home or returning after a long break, these 10 misunderstandings can easily trip you up—especially in Oregon's unique market.

Let’s break them down.

1. You have to save 20% or you can’t buy.

Not true. Most Oregon buyers don’t put 20% down. FHA loans allow 3.5% down. Conventional loans can go as low as 3%. If you're eligible for a VA or USDA loan (common in rural counties like Tillamook or Clatsop), you might not need a down payment at all.

Source: Fannie Mae

2. If it’s been on the market more than 2 weeks, something must be wrong.

That might be true in fast-moving neighborhoods. But in rural areas or unique markets like Portland's eastside or the Oregon coast, homes often sit longer. Days on market doesn’t mean red flags—it could mean the seller priced high or the home needs the right buyer.

Source: RMLS Market Action Report

3. I can’t buy unless my credit score is amazing.

You don’t need a perfect credit score. Many lenders work with buyers in the low 600s, and some loans go lower. Lenders evaluate your debt, income, and overall stability—not just your score.

Source: Consumer Financial Protection Bureau

4. Waiving inspections is the only way to win in Portland.

Waiving inspections was common during the bidding frenzies of 2021–22, but the market has cooled. Oregon law gives you inspection rights—use them. It’s your only chance to learn about potential repairs, sewer lines, radon risks, or roof condition before buying. Buying in Portland Metro? Radon is common, don't skip the test.

Source: ORS 105.464

5. Zillow’s Zestimate is what the home is worth.

Zillow’s estimates can be off by tens of thousands in Portland and the coast. That’s because algorithm-based tools don’t know if a home is next to a busy road or has a new roof. We use real-time data and neighborhood insights for a more accurate valuation.

Source: Zillow Zestimate Accuracy

6. If I love it, someone else will, so I better overpay.

You may love the house, but that doesn’t mean a bidding war is guaranteed. While some Portland neighborhoods are competitive, others aren't. Know your limits, stay strategic, and don’t let fear of missing out lead to buyer’s remorse.

Source: OregonLive

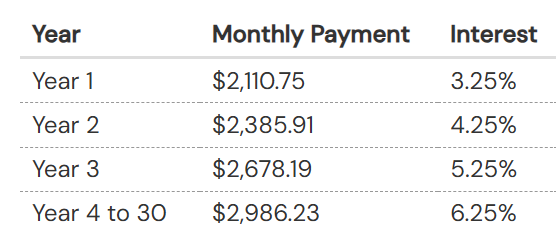

7. The mortgage payment is all that matters.

Monthly payment is important, but don't forget taxes, insurance, HOA fees, and long-term maintenance. In Oregon, expect potential costs for radon mitigation, sewer scopes, and earthquake insurance. Ask your agent for a realistic budget picture.

Source: City of Portland Property Tax Estimator

8. It’s impossible to buy a home with your partner or friends.

Buying with a partner (or chosen family) is very doable, but comes with legal complexities. Oregon doesn’t have common-law marriage, and how the title is written affects what happens if you split up. Get a co-ownership agreement to protect everyone involved. I have experience with more than two co-buyers and can point you in the right direction.

Source: Oregon State Bar

9. Buying a house will fix everything.

Owning a home can offer stability, but it won't fix burnout, financial anxiety, or life stress. If you’re struggling with overwhelm or decision fatigue, it’s okay to ask for help or take it one step at a time. (You’re not alone; I’m a neurospicy Realtor with lived experience.)

Source: Oregon DEQ Homeowner Guide

10. Your agent’s job ends at closing.

Not if you hire the right one. I help clients long after the keys are handed over—connecting them with contractors, tax resources, and guidance on life changes. Real estate isn’t just a transaction. It’s a relationship.

Source: StarrettRealtyGroup.com

Final Thoughts

Real estate doesn’t have to be overwhelming or full of guesswork. With a thoughtful, community-minded Realtor who understands Oregon’s quirks, you can move forward with clarity, without the myths.

If you're buying in NW Oregon or SW Washington, I'd love to support you.

Comments